Grow your business with invoice financing

Financing solution suitable for:

- Estonian registered businesses, trading for over 6 months and €50,000 minimum turnover

- Invoices with payment terms of 15-180 days

- Your client is a company trading 3+ years with a turnover of at least €0,5m per year

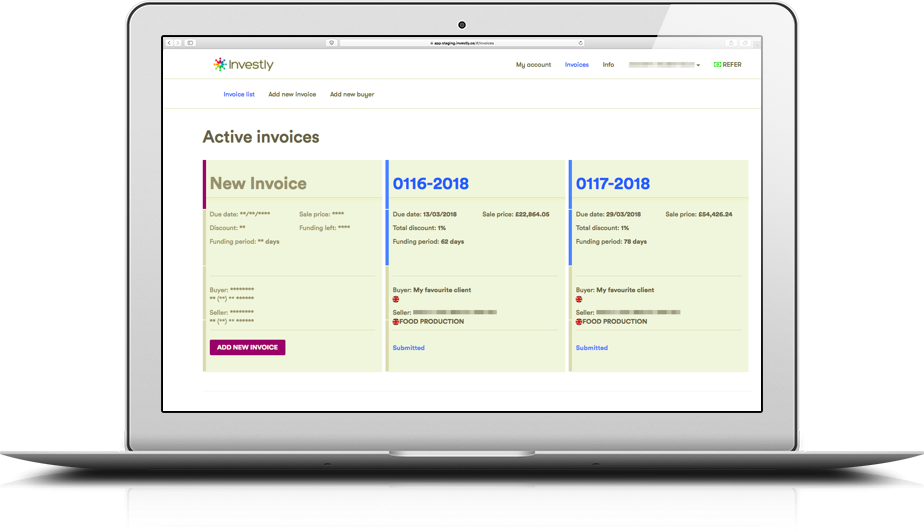

Finance your invoices:

Ready to sign up? Click here.

How invoice finance can help you?

Faster business growth

Hire more staff and win new contracts.

Better supplier payment terms

Many suppliers offer discounts for up-front or early payment.

Efficient payroll

Prompt payment for employees and subcontractors.

How does it work?

1. Deliver goods to your customer

1. Deliver goods to your customer

Your customer must have received the goods or service

2. Issue the invoice to your customer

2. Issue the invoice to your customer

After that, upload it to your Investly account

3. We verify the invoice

3. We verify the invoice

We require your customer to confirm the invoice details are correct

4. Your cash is credited to your account

4. Your cash is credited to your account

So you can get back to focusing on your business

2,744 years worth of waiting on payments saved

We're funding companies growth in sectors:

Different sector?

Request a free quote and we will get in touch.

Until today we funded invoices worth £70,805,295

What customers value in Investly?

Professional customer service

We use personal approach and always try to find the best solution for you

Quick decision

You'll receive an offer in 1-3 working days

Flexible pricing

We bring you the best price on the market, suited to your needs

Skin & Tonic case study

"I think there's a stigma and a barrier associated with asking for help and asking for money. If I were to start again I would have looked at invoice financing and Investly earlier in our journey to be able to help with cash flow and financing."

Josh Wade, CEO Skin & Tonic