INVESTLY.CO

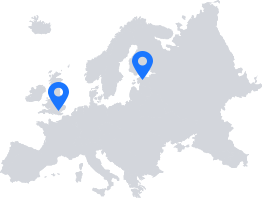

Auctions regarding invoices from Estonian based companies are brought to you and mediated by Investly Technologies OÜ in which case Investly Technologies OÜ General Terms will apply. Auctions regarding invoices from UK based companies are brought to you by Investly Ltd in which case Investly Ltd Terms of Use and Investly Ltd General Terms of Invoice Discounting will apply. Please read the following terms before using Investly, because by using Investly you can take financial obligations which are regulated by those terms.

United Kingdom (Investly Ltd) General Terms of Use

United Kingdom (Investly Ltd) General terms of invoice discounting

United Kingdom (Investly Ltd) General Terms of Use

1. INTRODUCTION

1.1. Welcome to our website at investly.co ("Website"). Our Website offers an auction platform introducing registered users to each other in order for users to finance invoices ("Platform") and is provided to you by Investly Ltd, a company registered in England and Wales at Companies House ("Investly", "Platform Operator", "us", "we" or "our"). Our registered office is at 65 London Wall, London EC2M 5TU and our registered number is 08966482.

1.2. Please read these general terms and conditions and the other terms and policies referred to in them (together, the "Terms of Use") carefully - they set out the basis on which you are allowed to use our Website and the auction services we provide through the Platform ("Services"). By registering with us, you acknowledge that you have read and understood these Terms of Use. These Terms of Use apply to our operation of the Website and the Platform and the relationship between you and us.

1.3. In addition to these Terms of Use, your use of particular services available through our Platform and your contract with any counterparty you contract with via the Platform will be subject to the Sales and Purchase Terms and the terms of the Invoice Discounting Agreement ("Invoice Discounting Agreement") which will be presented while signup. You should read carefully the terms which apply to the particular services you are using as these will apply once an agreement is formed between you and other registered user.

1.4. We recommend you save and/or print out a copy of these Terms of Use for your future reference.

2. REGISTERED USERS AND RESPONSIBILITIES

2.1. Only registered users (each a "User") may use the Platform and we have certain conditions which registered users must meet and accept or your registration is at our discretion:

- (a) Users may register for themselves, or where you have the right to represent a legal entity, on behalf of that legal entity;

- (b) Users must choose a unique username and password and provide an email address;

- (c) Users must be at least 18 years old.

2.2. By registering as a User you confirm you have read all these Terms of Use and the documents referred to in them and agree to abide by these Terms of Use. If you are registering on behalf of a legal entity (such as a director on behalf of a legal entity), by registering, you confirm that you are authorised to act on the relevant entity’s behalf.

2.3. Once registered and using the Platform, we provide certain information about your activity on the Platform through your User log-in and send you messages via the Platform.

2.4. Each User agrees to pay the Platform the applicable fee or fees which are set out in the Investly Price List available here and here. The fees payable are those valid and available on the Platform at the time of the relevant action (for example submitting a Sales Offer). These fees include bank charges, credit reference agencies fees, fees for arrears notifications and our service charges. Please check these fees carefully before submitting a Sales Offer or Purchase Offer. We reserve the right to charge interest in the event of a delay in the payment of such fees at the rate of 0.10% of the overdue amount per calendar day. We do not charge this interest on the fees payable on the transfer of the Sales Price (as defined below).

2.5. You can apply to register as a user and once your application has been approved, we will email you within fourteen days to confirm your registration and your log-in details.

2.6. As a User, you must:

- (a) not use the Platform for illegal transactions or operations, including fraud, money laundering or terrorism financing;

- (b) provide only true and up to date information when registering as a User and communicating or contracting with other Users;

- (c) keep confidential log-in details, usernames, passwords, not transfer or permit anyone else to use such details to access the Platform and inform the Platform Operator immediately if you know or suspect that a third party has gained possession of such details. You remain responsible for all actions and contracts concluded using your User account;

- (d) immediately inform the Platform Operator if there is a change to any of the User’s details;

- (e) act politely and respectfully when dealing with other Users or the Platform Operator.

2.7. We have the right to restrict or cancel a User’s access to and use of the Platform and to restrict or cancel live auctions and to refuse to perform our duties or obligations under these Terms of User if it becomes clear or we reasonably suspect that:

- (a) a User is in breach of these Terms of Use or any of their duties or obligations;

- (b) a User has given false, misleading and/or inaccurate information nor has neglected to submit important information;

- (c) a Sales Offer or Purchase Offer conflicts with applicable law or the principles of responsible lending.

3. USER IDENTIFICATION AND APPROVAL OF TRANSACTIONS

3.1. We shall establish the identity of every User and, in the case of legal entities, the identity of their shareholders as part of the registration process and before a User is permitted to make a Sales or Purchase Offer. If, as part of the Invoice Discounting Agreement, we are required to identify the User, we will repeat the same identification process carried out on registration.

3.2. In order for us to establish your identity as a User (or as a representative for a legal entity User), you must provide us with details of:

- (a) Your bank account details;

- (b) Your date of birth;

- (c) Passport details or other official identity document;

- (d) Address proof.

3.3. As part of User registration, each User who wishes to sell an Invoice via the platform shall submit to the Platform Operator the Invoice Seller’s bank account statements for the last six (6) months (i.e. the six (6) months preceding the Sales Offer) from all the credit institutions with which the Invoice Seller holds bank accounts. The bank account statements shall not be disclosed on the Platform and shall only be used by the Platform to verify the data submitted to the Platform (including any Sales Offer).

3.4. After initial registration as a User, and before making any Purchase Offer, each User who wishes to enter into an Invoicing Discounting Agreement as an Investor shall make a first payment to the User’s Investly Account (which we call a "verification payment") which allows us to verify the data submitted by the User on application for registration. The bank account, from which that verification payment is made, will be the bank account to which we will take or make payments for that User. If you wish to change your designated bank account, you must give us prior notice to enable us to take a new verification payment and verify your data.

3.5. When submitting Sales Offers, Purchase Offers, or confirming Invoice Discounting Agreements, you must be logged-in to the Platform. You will be asked to re-enter your registered password to confirm your identity and, in either case, by ticking a box to accept the applicable terms and conditions at the time you submit the relevant document.

4. USING THE PLATFORM AND HOW IT WORKS

4.1. We operate the Platform which allows you to enter into Invoice Discounting Agreements by following the specific procedure set out in these Terms of Use. In addition to your agreement with Investly to use our Platform (explained in these Terms of Use), by entering into an Invoice Discounting Agreement with another User via the Platform you are not entering into a separate agreement with Investly, but the counterparty (other User) to the relevant agreement. You should read carefully the full terms of the applicable agreement which include:

- (a) Sales and Purchase Terms (including the Sales Offer and Purchase Offer in Annexes 1 and 2) (which set out Investly’s limited role in providing the Platform); and

- (b) Invoice Discounting Agreement (the specific terms you and the counterparty agree with each other).

Part A and B will be agreed on while registration.

4.2. We recommend that you take further advice or guidance before taking any action based on the information contained on or generated by our Website and before making a Sales or Purchase Offer or entering into any Invoice Discounting Agreement.

4.3. Only registered users can use the services provided and you will need to log-in each time you want to use the Website.

4.4. As the Platform Operator, we make the services available via the Platform but we have a limited role to verify certain information prior to you entering into an Invoice Discounting Agreement and to provide certain administrative services (as described in these Terms of Use). We are entitled to a fee for our services in accordance with the applicable Prices List which is available here and here. By entering into the Invoice Discounting Agreement you confirm your agreement to paying such fees to us in accordance with these Terms of Use but once you enter into an Invoice Discounting Agreement, your contract is with the other registered user, your counterpart, and we are not a party to that Invoice Discounting Agreement.

4.5. As the Platform Operator, we communicate with Users via the Platform (through your user account) and via email (to the address submitted on registration). You agree that the email provided on registration is used by a person with authority to bind you in all legal agreements.

5. YOUR INVESTLY ACCOUNT

5.1. We maintain individual accounts for each User to facilitate settlements and transactions between us and Users and between Users arising from these Terms of Use (for example, but not limited to, payment of the fee for our Services) or from Invoice Discounting Agreements. We call your individual account your "Investly User Account".

5.2. Any payments you make as a User pursuant to these Terms of Use or the Invoice Discounting Agreement are held on the Investly’s current account with Santander which we call in these Terms of Use, the "Current Account". No interest shall be paid to the User by Investly for money held on the Current Account.

5.3. All money transferred to the Platform by a User on the basis of these Terms of Use (including any Invoice Discounting Agreement) may only be used by us pursuant to these Terms of Use and to perform our obligations set out in these Terms of Use.

5.4. The money transferred by the User to the Current Account is held by Investly on trust for the relevant User(s).

5.5. All payments made to the Platform by a User are recorded as receipts on the relevant User’s Investly User Account.

5.6. We have the right and obligation to make payment from or to each Investly User Account in order to facilitate the relevant User’s obligations under the applicable Invoice Discounting Agreement entered into with another User. Following the deduction of our fees and agreed expenses, debts payable to other Users under the Invoice Discounting Agreement shall be payable in the manner and order stipulated in the Invoice Discounting Agreement.

5.7. Each User may request that we refund any money held in the Current Account to the relevant User’s bank account. We will only make payments out to the same bank account a User originally used to make payment to the Current Account (which we match using the Platform’s software) and you will need to provide details of this bank account on registration.. Payments out at the request of a User will only be made if there is a positive balance in the relevant User’s Investly User Account. A "positive balance" means that there are funds remaining on that account after deducting any amounts which are due to Investly or other Users. We will execute the respective transfer order within one (1) Working Day (by which we mean a day which is not a Saturday or Sunday or any national or bank holiday in the UK).

6. FEES AND CHARGES THAT APPLY

6.1 Money transfers to Investly may be subject to bank charges from your transferring bank and you should check the costs of such transfers before making any transfers. You also acknowledge and agree to compensate Investly for any expenses or charges Investly incurs from your bank to allow Investly to receive your payments, and you shall promptly pay us such amounts on submission of our invoice.

6.2. Certain charges also apply:

- (a) where money is transferred from Investly to you (applicable bank charges);

- (b) where you are in default of payment and Investly sends notifications on your behalf;

- (c) on submission of data to credit reference agencies;

- (d) in relation to Surety Factoring or Secured Factoring services, any addition fees arising including any notarised security contract (primarily the notary fees);

each in accordance with the current Price List, which is available here and here.

6.3. Investly shall be entitled to invoice each User on use of the applicable fee-charging service, in accordance with the Price List and in the event payment is not made by the applicable due date, Investly shall be entitled to charge interest, on any overdue amounts, of 0.10% of the overdue amount per calendar day until full payment is made (calculated daily) except that interest shall not be charged on overdue amounts relating to the transfer of the Sales Price to the Invoice Seller under an Invoice Discounting Agreement (in accordance with paragraph 14 below).

6.4. Users shall be responsible for all other costs and expenses in connection with their use of the Platform and if a third party invoices Investly for any services or procedures ordered or used by a User in connection with their use of the Platform, Investly shall not be obliged to pay such invoice and shall instead, forward the respective Invoice to that User for payment.

7. ACCESS TO THE WEBSITE

7.1. You are responsible for making all arrangements necessary to access this Website. You are also responsible for ensuring that all persons accessing our Website through your internet connection are aware of these Terms of Use.

7.2. You are not permitted to use, or cause others to use, any automated system or software to extract content or data from our Website except in cases where you or any applicable third party has entered into a written agreement with us that expressly permits such activity.

7.3. You acknowledge that we cannot guarantee that our Website will:

- (a) stay the same as we might change or remove it or make access to it subject to registration or charges;

- (b) be compatible with all or any hardware or software which you may use;

- (c) be available all the time or at any specific time;

- (d) be accurate and up to date; or

- (e) be error-free or free of viruses, electronic bugs, Trojan horses or other harmful components and you must take your own precautions accordingly.

7.4. You also acknowledge that:

- (a) we cannot guarantee the speed or security of the Website; and

- (b) we will not be responsible for any damage or loss you may suffer directly or indirectly as a result of any virus attack that can be traced to our Website to the fullest extent permissible by law.

8. YOUR PRIVACY AND OUR USE OF COOKIES

8.1. The privacy of your personal data is important to us. Please see our Cookie & Privacy Policy, which forms part of these Terms of Use, for details of how we will process your personal data.

8.2. You must submit correct and accurate personal and other data. Provision of false or incomplete information is not permitted.

8.3. You must notify us immediately of any changes in your personal data in writing. Failure to notify us of any changes to your personal data constitutes a material breach of these Terms of Use.

8.4. This Website also uses cookies. Please see our Cookie & Privacy Policy, which forms part of these Terms of Use, for further details.

8.5. By registering as a User you accept these Terms of Use and agree that you will be liable for all damages suffered by the Platform Operator or other Users arising out or in as a result of the submission of false or incomplete information.

8.6. In addition to the use of your personal data as set out in our Privacy Policy, in the event of any payment problems we shall have the right to communicate your personal data, on behalf of the relevant counterparty to your Invoice Discounting Agreement, to credit reference agencies. By submitting a Sales Offer or a Purchase Offer, you give your consent to this sharing of data. We share the following data with the credit reference agencies: the name and registry of the User, the extent of credit problems, the time of occurrence of credit problems. The credit reference agencies we use are only permitted to share such data with third parties if they have a legitimate interest for processing the personal data and the credit reference agency has identified the legitimate interests, verified the accuracy of the data to be communicated and registered the data transmission.

9. OUR LIABILITY TO YOU

9.1. We are only liable to you in connection with your use of our Website for foreseeable losses which you suffer as a direct result of our breach of these Terms of Use or any obligations which we, as the "Platform Operator" referred to in the Sales Offers, Purchase Offers, or Invoice Discounting Agreements are obliged to perform.

9.2. We shall not be liable for any indirect, special, incidental or consequential damage or loss or for any business losses that you may incur, including but not limited to lost data, lost profits, business interruption, damage to goodwill or for any delay or failure to perform our own obligations due to circumstances beyond our own reasonable control.

9.3. In particular, we shall not be liable for:

- (a) incorrect or incomplete data given by any User;

- (b) breach of an Invoice Discounting Agreement or unlawful behaviour by any User;

- (c) non-fulfilment or improper fulfilment of a User's obligations under the Terms of Use including Sales Offers, Purchase Offers or Invoice Discounting Agreements;

- (d) the absence of the right of authority of the representative of a legal person User;

- (e) the validity and legality of any agreement entered into via the Platform.

Users enter transactions in the Platform directly and at their own risk, being a party to the transactions themselves.

9.4. We do not exclude our liability (if any) to you for:

- (a) personal injury or death resulting from our negligence;

- (b) our fraud or fraudulent misrepresentation; or

- (c) any matter for which it would be illegal for us to exclude or to attempt to exclude our liability.

10. INTELLECTUAL PROPERTY RIGHTS

10.1. Our Website, Platform and all information, images, photographs and other content displayed on the Website and Platform ("Material(s)") are protected by certain rights. These rights may include all patents, rights to inventions, copyright and related rights, moral rights, trademarks and service marks, business names and domain names, goodwill and the right to sue for passing off or unfair competition, rights in designs and all other intellectual property rights, in each case whether registered or unregistered ("Rights"). These Rights either belong directly to Investly or are licensed to us from their respective owners or licensors.

10.2. You may only view, print out and use the Website for your own personal, non-commercial use. We expressly reserve all Rights in and to the Website and the Materials and your use of the Website and Materials is subject to the following restrictions. You must not:

- (a) remove any copyright or other proprietary notices contained in the Materials;

- (b) use any Materials from our Website in any manner that may infringe any of our Rights or the Rights of a third party; or

- (c) reproduce, modify, display, perform, publish, distribute, disseminate, broadcast, frame, communicate to the public or circulate to any third party or exploit our Website and/or the Materials in any way, including for any commercial purpose, without our prior written consent.

10.3. In particular we reserve all Rights in and to the investly.co domain names and all related domains and sub-domains, the name "Investly", our logo and our service marks, brand names, trading names and/or trademarks appearing on the Website. Other trademarks, products and company names mentioned on the Website may be the trademarks of their respective owners or licensors and the Rights in such marks are reserved to their respective owners or licensors.

10.4. Nothing in these Terms of Use should be construed as granting any licence or right to use any such trademark or domain name.

10.5. Any use of the Website or the Materials in a manner not expressly permitted by these Terms of Use may constitute an infringement of our Rights or the Rights of our Licensors. We and our Licensors reserve the right to exercise all rights and remedies available in respect of any infringement of Rights in the Website or the Materials accessible on it.

11. VARIATIONS

11.1. We may from time to time vary these Terms of Use and/or the other terms and policies referred to in these Terms of Use.

11.2. We will inform you of any variations and unless otherwise notified to use, such variations shall become effective four (4) weeks after the published notification.

11.3. If you continue to make use of the Services via the Platform, you are deemed to have accepted such variations. If you do not agree to such variations, you should not use our Website and should give us notice to terminate your User registration.

11.4. Note that Users may also separately agree variations to any Invoice Discounting Agreement to which they are a party in accordance with paragraph 13 of the Invoice Discounting Agreement.

12. THIRD PARTY WEBSITES

12.1. Our Website may contain links to third party websites. If you decide to visit any third party site, you do so at your own risk. We are not responsible for the content, accuracy or opinions expressed on such websites. Links do not imply that we are, or our Website is, affiliated to or associated with such sites.

12.2. Your browsing and interaction on any other website, including websites which have a link to our Website, is subject to that website’s own rules and policies. Please read those rules and policies before proceeding.

13. TERMINATION OF A USER AGREEMENT

13.1. A user may only terminate their registration and this agreement (formed by acceptance of these Terms of Use) (we call this your "User Agreement") if all obligations towards other Users and Investly arising from any agreements concluded via the Platform have been fulfilled, offers made and acceptances given by the User via the Platform have ended and the User’s Investly User Account balance is zero.

13.2. The User Agreement can be terminated by the User at any time be giving at least fourteen (14) days’ written notice to us by email to support@investly.co.

13.3. We may terminate the User Agreement and a User’s access to the Platform at any time, by giving no less than two (2) months’ written notice, if the User violates the terms and conditions of the Terms of Use.

13.4. Following notification of termination of the User Agreement, we may refuse to process any Offers submitted by the User for any Invoice Discounting Agreement and limit the functionality of the Platform and the User’s access to the Platform.

13.5. Withdrawal from the User Agreement shall not automatically cause the Invoice Discounting Agreement entered into by the User to expire. We shall have the right to give notice to terminate all the Invoice Discounting Agreements entered into by the User on termination of the User Agreement by a User. Such notice shall automatically result in the obligation for the affected Investors to re-assign to the applicable Invoice Seller(s) (defined in the Invoice Discounting Agreement), for a fee, all the claims arising from the Invoice assigned under the Invoice Discounting Agreements and the underlying contract (the "Repurchase Obligation") and the Invoice Seller shall immediately have the obligation to pay the Investor for the re-assignment of the respective claims (the "Repurchase Price"), if the Buyer who is the receiver of the respective invoice has not yet paid the invoice to the Investor(s) who acquired it. Further details of the Repurchase Obligations are set out in paragraph 25 below.

14. INSOLVENCY OF THE PLATFORM OPERATOR

14.1. In the unlikely event that Investly becomes insolvent:

- (a) entry into any new Invoice Discounting Agreements will no longer be possible and all active auctions shall be cancelled. Any money held in Investly User Accounts will be returned to the relevant User;

- (b) each User shall be entitled to all information available from Investly’s database regarding their contractual relationships entered into via the Platform; and

- (c) the insolvency or liquidation of Investly shall not affect the validity of any existing Invoice Discount Agreements in place between Users. In such cases, any payments arising from the Invoice Discounting Agreements shall be made directly to the respective settlement account of the parties to the respective agreements.

15. ENQUIRIES AND COMPLAINTS

If you have an enquiry or complaint about this Website, you should contact 65 London Wall, London EC2M 5TU and we will try to answer your enquiry or resolve any complaint as soon as possible.

16. REGULATION

16.1. The Invoice Discounting Agreements do not constitute regulated investments under the Financial Services and Markets Act 2000 (’FSMA’) and Investly is not regulated by the Financial Conduct Authority (’FCA’) in the United Kingdom in respect of its activities in relation to those agreements carried on in the United Kingdom. Accordingly, neither the Investor nor the Invoice Seller will be able to:

- (a) complain to the FCA about any act or failure to act by Investly in relation to, or in respect of, any aspect of an Invoice Discounting Agreement or in relation to, or in respect of any aspect of a Users use of the Platform;

- (b) bring any such complaint to the Financial Ombudsman Service;

- bring a claim to the FCA or to the Financial Services Compensation Scheme should they suffer any financial loss in the event of the insolvency of Investly.

17. GENERAL PROVISIONS & APPLICABLE LAW

17.1. You may not assign, sub-license or otherwise transfer any of your rights under these Terms of Use.

17.2. If any provision of these Terms of Use is found to be invalid for any reason, the invalidity of that provision will not affect the remaining provisions of these Terms of Use, which shall remain in full force and effect.

17.3. Failure by either of us to exercise any right or remedy under these Terms of Use does not constitute a waiver of that right or remedy.

17.4. Provisions which are expressly applicable after termination of a User Agreement or which by their nature should apply after termination, will continue to apply following termination of the User Agreement.

17.5. The English Courts will have exclusive jurisdiction over any claim arising from or related to this Website and/or use of the Platform.

17.6. English Law will apply to these Terms of Use and to the contracts and relationships arising through the use of the Platform.