Thanks for all the contributors on blogs, forums as well as LinkedIn and Facebook groups. We put together a summary of all the questions and concerns raised.

Investly's risk management process consists of three pillars:

As we don't have a long history of giving out loans on our own, we can rely on the market data. In Estonia, the best provider for that is the Bank of Estonia, who collects this information from all credit providers.

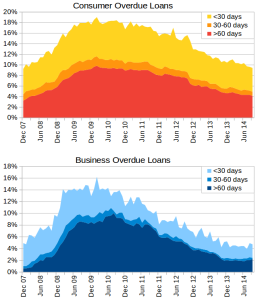

This is a breakdown of

the overdue rates. As an industry standard, P2P loans in Estonia are considered to be defaulted, when they are more than 60 days overdue.

We can see that the overdue rate has consistently been lower in case on companies throughout the credit cycle averaging around 2-4% during normal times with a peak of 8.5% during the deepest recession.

Consumer loans tend to have consistently higher default rates accross the cycle. This is aligned with the proposal that the loans taken by the businesses will actually improve the cash generation power of the company compared to consumer lending. E.g. a company investing into it's production capacity has higher return on investment than an individual taking out a loan for consumption.

Our financial analysts price the loans according to the economic cycle with respect to expected future fluctuations in the business environment, so our investors would earn a solid return throughout the economic cycle.

Creditscoring

We evaluate risks involved with the specific offer. This consists of due diligence (its business, background and the directors) and financial risk (balance sheet, income statement, cash flow analysis, industry and sector specific effects). We did a longer piece on this just last week: "How does Investly manage risks?"

Debt collection

The Investly team maintains good contact with all of its clients. We process their business information and stay in touch with them directly through the application process. In case there are delays in payment we will actively communicate to the company to remind them and understand the cause of delay. The timeline in regards to due date:

-3 days: e-mail with upcoming payment details

0 days: company makes a payment from their bank account to their Investly account

+1 day: e-mail overdue payment reminder

+3 days (recurring every 7 days until resolution): e-mail and text message requesting the company to take immediate action to repay the debt or contact us in order to find a solution.

+7 days (recurring every 14 days until resolution): letter by post with request for immediate action to repay the debt or to contact us in order to find a solution

+10 days: phone call in order to find a solution

+14 days: e-mail notifying the company of the start of legal action and possible charges

+30 days: company details will be published with the local credit bureau

After this consistent communication, Investly will decide based on the communication whether to pursue do debtor for another month, file a court case with the local court or sell the claim to a debt collection agency.

In conclusion, these three pillars support our processes of handling all the risks involved in the investment activity. We have based our procedures on the industry's best practices and brought in extra value in terms of credit scoring, where we saw great potential for many technological improvements in terms of methodology and the accessible data. This is a sound framework which we constantly review as we go through different cycles of the economy.

Have a look at our latest offers and how their risk return profile!