In September, we surveyed our investors both in Estonia and in Europe generally to find out what are the most important aspects they consider before investing on the Investly platform and what are the elements that most influence their decisions. We surveyed 21 Estonian speaking and 17 investors English speaking investors mostly from Europe.

The results are now in, and interestingly, there are some notable differences in the priorities of Estonian and English speaking investors worth mentioning.

Data vs Story

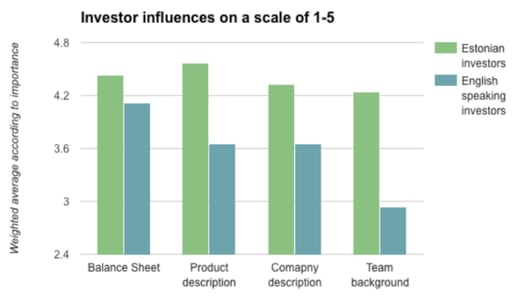

Compared to Estonian investors, their English counterparts tend to focus more on factual and numerical data when making a decision about investing and reducing their risks. English investors look closest at the company’s balance sheet, maximum interest rate given by the company as well as Investly’s credit rating and last year’s turnover. For Estonian investors, next to the obvious choice of ranking company balance sheet as a priority, company and product description rated considerably higher in their checklist than for English investors. When specifically asked about what influences their investment decision, Estonians tended to focus on the company’s business plan, the idea, and purpose of the loan a lot more than the English speakers.

Estonians rated the story and the team behind the company much higher than numerical data, whereas other investors prioritised data, security, loan duration as well as why the company chose Inveslty among all the other alternatives.

Experience matters

The curious differences between the surveyed investors might derive from the actual hands-on experience they have with different peer-to-peer funding platforms they have used in addition to Investly. On average, our English investor has used 8 different platforms, but the Estonian investor only 3. This illustrates their involvement in the P2P lending industry as well as the scope of aspects they consider when making an investment. English investors tend to have more know-how of how P2P lending can be done through an online platform, therefore they also have more experience in what works for them and what does not in terms of the actual investment and the company. Platform viability is equally important to the data behind the potential investee.

Estonian investors on the other hand have considerable less experience with P2P lending platforms, but this may not be potentially a negative thing. They are aware enough of different platforms to provide constructive criticism towards Inveslty, which helps us improve our product and services, but they also look very closely at the company they think of investing in, focusing on the people and idea behind it and evaluating how the business idea and their potential for growth can benefit them directly.

See our investment offers here.

The most important thing Investly got out of this survey, it is that Estonian and UK investors are different, as are their priorities and influences when making a decision to invest. For us, drawing attention to these differences is as important as the actual elements in their investment checklists. Doing business varies from country to country, and so does making an investment. Investly’s goal therefore is to consider those differences, implement the feedback we have gotten to our platform and continue providing the best service possible to a wide variety of investors with equally wide variety of priorities.