Albert Einstein is quoted having said that compound interest is the 8th wonder of the world. A portfolio growing 10% annually will double in just 7 years assuming income is reinvested (35 years for 2%). However, a small fee can eat away a sizeable piece from your returns, slowing down the growth rate of your portfolio. Fees are important, so let’s take a closer look at how fees affect your portfolio over time.

Fees matter

Two of our largest competitors, Platform Black and MarketInvoice, both take fees from investors. The former charges 10% from any profits made by investors while the latter charges 20-30% depending on the size of the portfolio.

A 10% fee might seem small at first, but over time it can have a sizeable impact on your portfolio. Fees reduce the value of your interest income, but over time you also lose out on any return you would have earned if you had been able to earn by reinvesting.

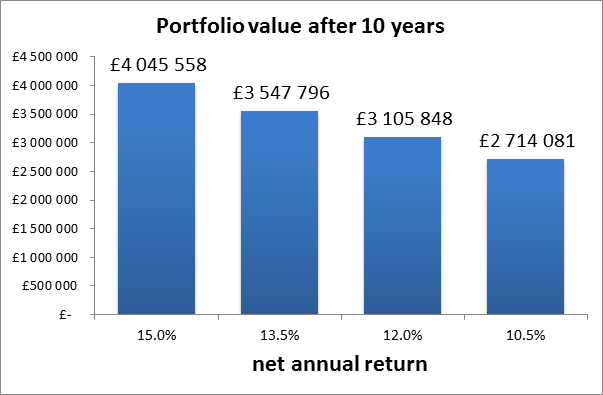

To illustrate this, let’s look at a portfolio with a starting balance of £1,000,000 earning 15% interest annually before fees. After fees of 10, 20 and 30%, the net return after fees is 13.5, 12.0 and 10.5%. The first chart shows you the value of 4 portfolios after 10 years with the same return but different fees.

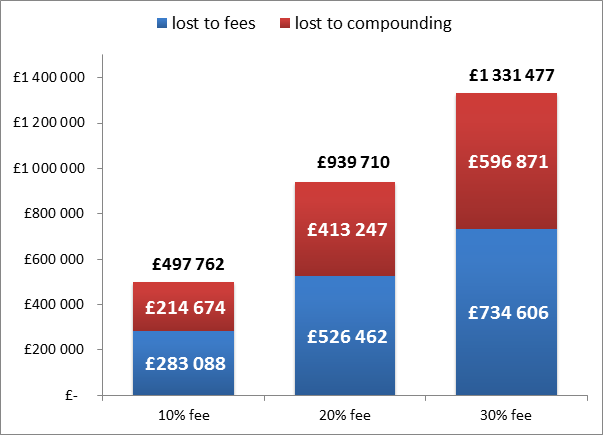

While investors were only charged €734,000 in fees, the total income lost due to fees was £1.3 million compared to a portfolio without fees. Roughly half of the losses are from fees, the other half from money that could’ve been made by reinvesting that money.