Most people associate marketplace lending, also known as peer to peer lending, with consumer and real estate loans. Although Investly is similar to marketplaces that are oriented toward real estate and consumer loans in the sense that a large pool of investors takes part in financing each issue, there are some[...]

Kristjan Velbri

Recent Posts

We asked our customers for tips on how they got better prices from their suppliers. Here’s what they came up with.

Demand for invoice financing is growing fast. To keep up with demand, we visited LendIt Europe, the largest P2P conference in Europe. We met our shareholders and a number of investors interested in invoice financing. We're also growing as a team. We've moved offices in London to allow further expansion of our UK team.[...]

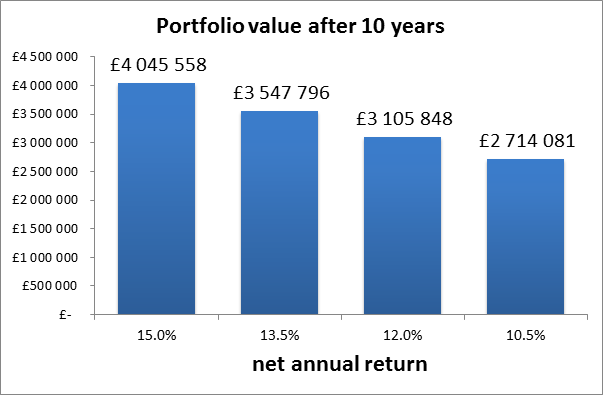

Albert Einstein is quoted having said that compound interest is the 8th wonder of the world. A portfolio growing 10% annually will double in just 7 years assuming income is reinvested (35 years for 2%). However, a small fee can eat away a sizeable piece from your returns, slowing down the growth rate of your[...]

September was a very busy month for the whole team at Investly. We signed up a record number of new customers and investors purchased a record amount of invoices. We also implemented a few improvement to the website.

Small companies face an uphill battle - buyers leverage long-payment terms on invoices and banks are often unable to give businesses the access to the funds they need. Large companies are demanding longer payment terms than ever before.

Investly allows businesses to unlock cash from their invoices, resulting in increased sales and improved liquidity. Without it, businesses would have to wait weeks or months to receive payment. Just like many small businesses in the UK, Matt and Ben’s Proper Fudge Company faced long payment terms of 60 days on their[...]

Volume and the number of invoices traded keep making new highs. More importantly, we are seeing a lot of customers return after having sold their first invoice. The demand has been so great that we're looking for new employees in London and Tallinn. It makes us happy to be able to provide a solution that companies[...]