Since inception Investly has facilitated 15 business loans totaling 118,556 euros. To make it easier for you to analyze the data, we've compiled all the loan repayments into a single spreadsheet. What are the things that an investor should take away from the data?

Since inception Investly has facilitated 15 business loans totaling 118,556 euros. To make it easier for you to analyze the data, we've compiled all the loan repayments into a single spreadsheet. What are the things that an investor should take away from the data?

Expected return

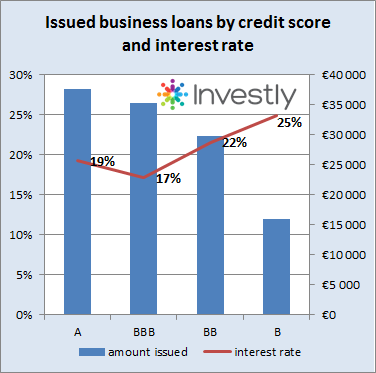

For investors, the expected return is definitely of upmost importance. Business loans issued via Investly have an average expected return of 17.3%. That leaves bank deposits and dividend stocks far behind and beats most crowdlending platforms. Of course, each asset class has a unique risk profile and diversification between asset classes should be considered. We do the best we can to ensure that each and every loan issuer on our platforms is creditworthy. Loans issued via Investly have a personal guarantee by the debtor company’s director. This lends credibility as the company will be motivated to avoid defaulting on the loan. In case of default, the investors have rights to the director’s assets.

Payments

As of the 18th of January this year, 33% of the total amount of loans has been repaid. Three loans have been repaid completely and only one has defaulted (we have issued an order for payment, to which the company has 15 days to reply; after that a bailiff will proceed with liquidating the assets of the company and/or guarantor). We are currently waiting for further developments, but we remain optimistic and consider repayment likely. In summary, we can say that the Investly credit scoring model has proven itself to be reliable.

Late payments

A total of six companies have had made late payments on their monthly loans repayments, this is to be expected.. A key difference to keep in mind when comparing loans issued to companies and private persons, is the fact that private persons, in most cases, have a fixed monthly income. They can use the monthly income to make loan repayments. However, companies do not have a fixed income and depend to a large extent on timely payment of invoices by their customers. A customer’s late payment has a domino-effect on the debtor company as they will be unable to make the loan payment on time. However, investors shouldn’t be concerned, because late payments are usually resolved in a timely manner. Our customer support team is in continuous communication with companies to identify reasons for late payment and to find out the expected date of payment. Companies that are late will pay a late payment fee.

For small and medium sized business late payment for invoices is a concern as their current assets are fairly limited in size. Investly is working on brokering invoice financing in Estonia. It is a service very similar to factoring, but it is cheaper and doesn’t tie the issuing company with long term agreements or have any hidden fees. Click here to find out how Investly can help you unlock cash from your invoices.

To discuss the data, new loan offers or anything else you have on your mind, head over to our LinkedIn or Facebook discussion groups