You run a small business with big ambitions. You and your team have plenty of inspiration, you’re not afraid of perspiration, and you’re hungry to grow. So what is standing in your way, and preventing your business from reaching its goals?

Times are changing, and so are the finance options for small businesses. With the alternative finance market in the UK reaching a whooping £3.2 billion in 2015, maybe it's time for your business to get a slice of the funding pie?

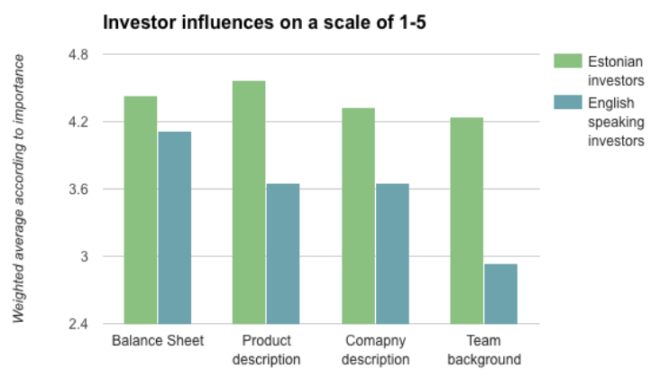

In September, we surveyed our investors both in Estonia and in Europe generally to find out what are the most important aspects they consider before investing on the Investly platform and what are the elements that most influence their decisions. We surveyed 21 Estonian speaking and 17 investors English speaking[...]

In the last few months we have received a number of funding requests from customers all with the same problem - the banks were turning them down when they applied for a business loan. Most of these companies are reliable businesses with their finances in good shape. Typically, however, they lack personal wealth or[...]

Sixteen people invested on our platform to enable our first business to purchase essential machinery that they needed to grow.