Josh Wade, the director of Skin & Tonic, has used Investly since December 2016. They sell their organic cosmetics in over 20 different countries through their ecommerce site and wholesale line.

Investly allows businesses to unlock cash from their invoices, resulting in increased sales and improved liquidity. Without it, businesses would have to wait weeks or months to receive payment. Just like many small businesses in the UK, Matt and Ben’s Proper Fudge Company faced long payment terms of 60 days on their[...]

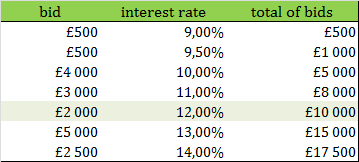

A classic auction involves participants making ever-higher bids. That is the model used by eBay, for example. Investly uses reverse auctions, where participants make ever-lower bids. Investors bid on invoices, bids compete by lowering the discount rate. After one to three days the auction ends and the company is given[...]

lnvestly, a peer-to-peer lending platform that helps small business release cash tied up in invoices is gearing up for its launch in the UK and is offering an early access pilot program to a limited number of users.

There are two main options when companies are looking to sell their invoices: factoring and invoice discounting. There are some key differences that are worth considering to ensure you get the service that is right for you and your business.

In order to make the invoice discounting service as simple and easy to understand as possible, we have given a short example of a real life situation:

Example 1: Company perspective

A Company called Vitality Ltd issued an invoice worth £10,000 to their client Avangers Ltd for products that had already been delivered.[...]

Sixteen people invested on our platform to enable our first business to purchase essential machinery that they needed to grow.