We asked our customers for tips on how they got better prices from their suppliers. Here’s what they came up with.

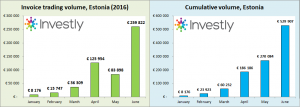

June was another busy month for Investly. We broke records in the UK and Estonia both in terms of the volume of invoices sold but also the number of new customers who sold their first invoice. July should see a noticeable pick-up in the UK as we have a new sales person joining our London team.

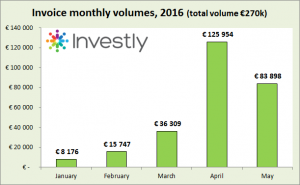

The month of May saw a slight decrease in invoice volumes, but overall the month was successful. In April we sold quite a few large invoices which pushed up the average invoice value and the monthly volume. However, the overall trend is positive: we had four new companies sell their first invoice and many more have[...]

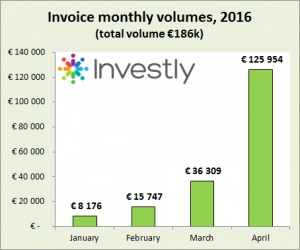

Another month has passed and it's time to have a look at the data. April was a another record-breaking month for Investly, it was the first time we sold more than €100,000 worth of invoices in one month. That brings the total to €186,186. This was achieved with the help of new and existing customers and investors.[...]

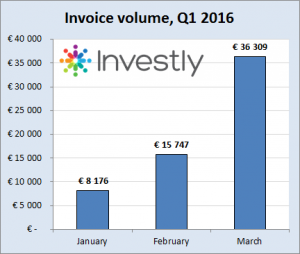

The quarter has come to an end and it's time to have a look at the data. The first quarter was quite busy as we started offering invoice discounting not just in Estonia, but in the United Kingdom as well. Invoice discounting is doing great in Estonia, both local and international investors have quickly adapted to this[...]

Since inception Investly has facilitated 15 business loans totaling 118,556 euros. To make it easier for you to analyze the data, we've compiled all the loan repayments into a single spreadsheet. What are the things that an investor should take away from the data?

Thanks for all the contributors on blogs, forums as well as LinkedIn and Facebook groups. We put together a summary of all the questions and concerns raised.

Investly's risk management process consists of three pillars:

As we don't have a long history of giving out loans[...]