Investly has announced a partnership with iContract, a UK platform that connects contractors with recruiters, in order to provide invoice finance for contractors with long payment terms. The invoice finance solution is available for contractors who operate as a limited company.

Investly has announced a partnership with e-invoicing operator Telema in order to provide e-invoice financing for Estonian businesses. The new service, also known as e-factoring, allows retail chain suppliers to automatically finance their e-invoices with long payment terms.

September was a very busy month for the whole team at Investly. We signed up a record number of new customers and investors purchased a record amount of invoices. We also implemented a few improvement to the website.

Small companies face an uphill battle - buyers leverage long-payment terms on invoices and banks are often unable to give businesses the access to the funds they need. Large companies are demanding longer payment terms than ever before.

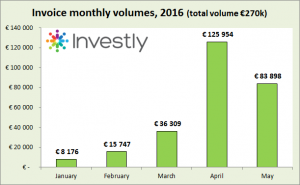

The month of May saw a slight decrease in invoice volumes, but overall the month was successful. In April we sold quite a few large invoices which pushed up the average invoice value and the monthly volume. However, the overall trend is positive: we had four new companies sell their first invoice and many more have[...]

We've got important news for you! We're honored to have received the Crowdfunding Best Practices label by FinanceEstonia and Law Firm Deloitte Legal. Also, we have updated our business model and decided to start participating in invoice auctions, further aligning our interests with those of investors.

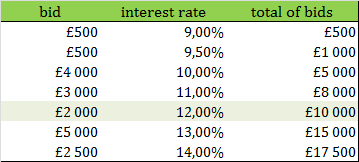

A classic auction involves participants making ever-higher bids. That is the model used by eBay, for example. Investly uses reverse auctions, where participants make ever-lower bids. Investors bid on invoices, bids compete by lowering the discount rate. After one to three days the auction ends and the company is given[...]

There are two main options when companies are looking to sell their invoices: factoring and invoice discounting. There are some key differences that are worth considering to ensure you get the service that is right for you and your business.

-1.png)