On the build-up to Christmas 2017, we are keen to share some of our top cash flow tips with our customers. Here is our recipe for cash flow success this Christmas:

Here at Investly, we are aware that food businesses are some of the worst affected by poor cash flow, as grocery retailers tend to have lengthy payment terms. Typically growing food businesses in the UK will end up waiting 30-90 days to get paid for their goods - sometimes even as long as 180 days.

Josh Wade, the director of Skin & Tonic, has used Investly since December 2016. They sell their organic cosmetics in over 20 different countries through their ecommerce site and wholesale line.

Whilst you're busy running the day-to-day operations, sneaky subscriptions and unnecessary costs can easily bloat your company budget. However, as we've learned from our customers, awareness of alternative options is key to avoiding these common pitfalls.

We asked our customers for tips on how they got better prices from their suppliers. Here’s what they came up with.

Most of us agree that Christmas is a lovely time of year. There's bright lights, delicious food and drinks, and - of course - the office parties…

You run a small business with big ambitions. You and your team have plenty of inspiration, you’re not afraid of perspiration, and you’re hungry to grow. So what is standing in your way, and preventing your business from reaching its goals?

Demand for invoice financing is growing fast. To keep up with demand, we visited LendIt Europe, the largest P2P conference in Europe. We met our shareholders and a number of investors interested in invoice financing. We're also growing as a team. We've moved offices in London to allow further expansion of our UK team.[...]

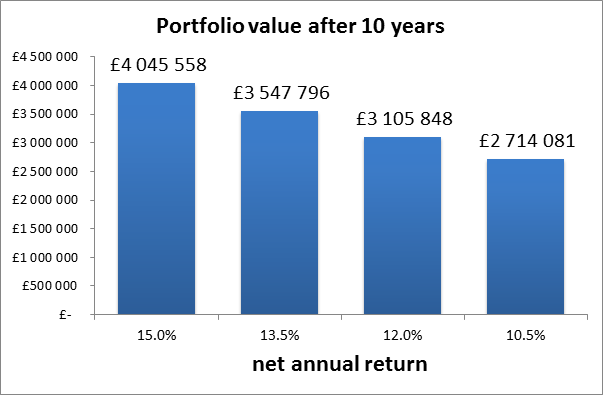

Albert Einstein is quoted having said that compound interest is the 8th wonder of the world. A portfolio growing 10% annually will double in just 7 years assuming income is reinvested (35 years for 2%). However, a small fee can eat away a sizeable piece from your returns, slowing down the growth rate of your[...]