September was a very busy month for the whole team at Investly. We signed up a record number of new customers and investors purchased a record amount of invoices. We also implemented a few improvement to the website.

Small companies face an uphill battle - buyers leverage long-payment terms on invoices and banks are often unable to give businesses the access to the funds they need. Large companies are demanding longer payment terms than ever before.

Investly allows businesses to unlock cash from their invoices, resulting in increased sales and improved liquidity. Without it, businesses would have to wait weeks or months to receive payment. Just like many small businesses in the UK, Matt and Ben’s Proper Fudge Company faced long payment terms of 60 days on their[...]

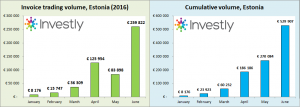

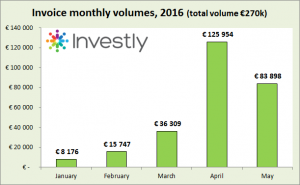

Volume and the number of invoices traded keep making new highs. More importantly, we are seeing a lot of customers return after having sold their first invoice. The demand has been so great that we're looking for new employees in London and Tallinn. It makes us happy to be able to provide a solution that companies[...]

June was another busy month for Investly. We broke records in the UK and Estonia both in terms of the volume of invoices sold but also the number of new customers who sold their first invoice. July should see a noticeable pick-up in the UK as we have a new sales person joining our London team.

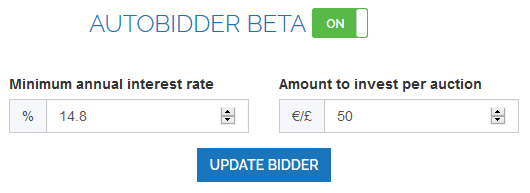

Investly’s autobidder has been available to investor for a little over two months now. By the second half of June, 152 investors were using it. Assuming their accounts were fully funded, the total bidding size of these investors is almost 8000 euros. Because the autobidder is gaining acceptance among investors, we[...]

The month of May saw a slight decrease in invoice volumes, but overall the month was successful. In April we sold quite a few large invoices which pushed up the average invoice value and the monthly volume. However, the overall trend is positive: we had four new companies sell their first invoice and many more have[...]

We've got important news for you! We're honored to have received the Crowdfunding Best Practices label by FinanceEstonia and Law Firm Deloitte Legal. Also, we have updated our business model and decided to start participating in invoice auctions, further aligning our interests with those of investors.