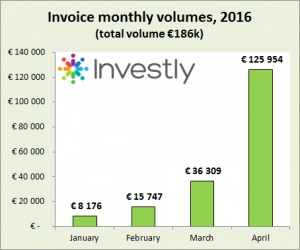

Another month has passed and it's time to have a look at the data. April was a another record-breaking month for Investly, it was the first time we sold more than €100,000 worth of invoices in one month. That brings the total to €186,186. This was achieved with the help of new and existing customers and investors.[...]

Times are changing, and so are the finance options for small businesses. With the alternative finance market in the UK reaching a whooping £3.2 billion in 2015, maybe it's time for your business to get a slice of the funding pie?

Meet Metsanotsu (literally translated as Forest Piglet), an Estonian company that provides retail chains with great quality firewood. After encountering long payment terms from their clients, they decided to give Investly and invoice financing a try.

Having sold their first invoice to investors for a small discount,[...]

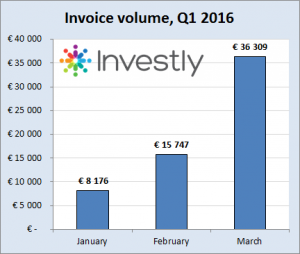

The quarter has come to an end and it's time to have a look at the data. The first quarter was quite busy as we started offering invoice discounting not just in Estonia, but in the United Kingdom as well. Invoice discounting is doing great in Estonia, both local and international investors have quickly adapted to this[...]

Although Investly is now available in the United Kingdom as well as Estonia, we started out in the latter. As such, most of our investors, so far, are Estonians. We do have a growing group of foreign investors because we are open to investors from the European Economic Area. Perhaps the most exciting development has[...]

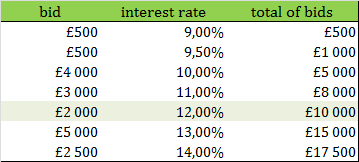

A classic auction involves participants making ever-higher bids. That is the model used by eBay, for example. Investly uses reverse auctions, where participants make ever-lower bids. Investors bid on invoices, bids compete by lowering the discount rate. After one to three days the auction ends and the company is given[...]

lnvestly, a peer-to-peer lending platform that helps small business release cash tied up in invoices is gearing up for its launch in the UK and is offering an early access pilot program to a limited number of users.

Since inception Investly has facilitated 15 business loans totaling 118,556 euros. To make it easier for you to analyze the data, we've compiled all the loan repayments into a single spreadsheet. What are the things that an investor should take away from the data?

There are two main options when companies are looking to sell their invoices: factoring and invoice discounting. There are some key differences that are worth considering to ensure you get the service that is right for you and your business.

In order to make the invoice discounting service as simple and easy to understand as possible, we have given a short example of a real life situation:

Example 1: Company perspective

A Company called Vitality Ltd issued an invoice worth £10,000 to their client Avangers Ltd for products that had already been delivered.[...]